Watch Out for Wage-Hour Minefields

Creative incentive packages can be an effective means to attract workers, but employers need to ensure they accurately calculate wages owed.

Michaelle L. Baumert and Catherine A. Cano

2/1/2020

In the struggle to attract and keep good employees in today’s competitive job market, many long term care facilities offer creative incentive packages. Employers that do so without fully understanding wage and hour implications put themselves at risk for devastating liability. Federal law makes it easy for employees to pursue claims as a group and provides successful plaintiffs automatic doubling of back pay. Simple mistakes can create liability in excess of $100,000, and, occasionally, over $1 million.

As staffing challenges grow, maintaining appropriate levels is more important and complex than ever. The Centers for Medicare & Medicaid Services’ (CMS’) Five-Star Quality Rating System is based partly on nursing staff per resident. In 2019, CMS updated staffing ratios and added an automatic downgrade to one star for facilities that report at least four days per quarter with no registered nurse on site. Many states also impose stringent staffing ratios.

Employers that rely on payroll companies for wage calculations retain responsibility. Vendors can—and do—make errors, especially when employers don’t understand the overtime implications on incentives and bonuses.

Following are some issues and potential pitfalls that long term care employers and their payroll and human resources departments should watch for.

Fair Labor Rules

The general rule under the Fair Labor Standards Act says employers must pay overtime to non-exempt workers for all hours over 40 in a work week at not less than one and one-half times the employee’s regular rate, as spelled out in Title 29 of the U.S. Code of Federal Regulations (CFR). That “regular rate” is not necessarily the employee’s base rate.

To calculate the regular rate, divide total renumeration in a work week by the total hours worked (including overtime hours). Do not include dollars or hours paid but not worked, such as vacation.

- Shift Differentials/Incentives. Generally, shift differentials must be included in the employee’s regular rate of pay for determining overtime. The same is true for incentives offered to fill open shifts or work certain days.

- Payroll Pointer. Premium pay for working on a “special day” (holiday, weekend, or scheduled day off) that is not less than the employee’s overtime rate can be excluded from the regular rate and counted toward the employer’s overtime obligation in some circumstances, according to the CFR. Given the complexity of this determination, employers should consult with legal counsel.

- Payroll Pointer. Employers can limit the need for some complex rate calculations by carefully structuring bonuses to be based on a percentage of total earnings before the employee provides the services. In that case, per federal code, the employer does not need to recalculate overtime on the bonus payment.

For example, the employer could offer a retention bonus of 15 percent of the employee’s annual straight-time and overtime earnings. Because the percentage applies to the employee’s overtime earnings, no further calculation is needed.

- Multiple Rates. When different rates are paid for two different jobs, the default rule is to pay overtime based on the weighted average (that is, total compensation divided by total hours worked).

- Discretionary Bonuses. Payments made to employees without obligation or prior promises may be excluded from the regular rate and not subject to overtime calculations. Discretionary bonuses are uncommon; think twice before excluding any bonus from the regular rate.

- Nondiscretionary Bonuses. Most nondiscretionary bonuses must be included in the regular rate for the weeks when the bonus was earned. Referral bonuses do not need to be included, according to U.S. Department of Labor guidelines, if “1.) participation is strictly voluntary; 2.) recruitment efforts do not involve significant time; and 3.) the activity is limited to after-hours solicitation done among friends, relatives, neighbors, and acquaintances.”

A bonus is considered nondiscretionary under federal regulations if the employer has promised, agreed, or even implied that it would pay it. Examples include attendance, production, quality, and retention bonuses. The employer must identify each work week during which the employee earned overtime and calculate the additional overtime due.

Adding it Up

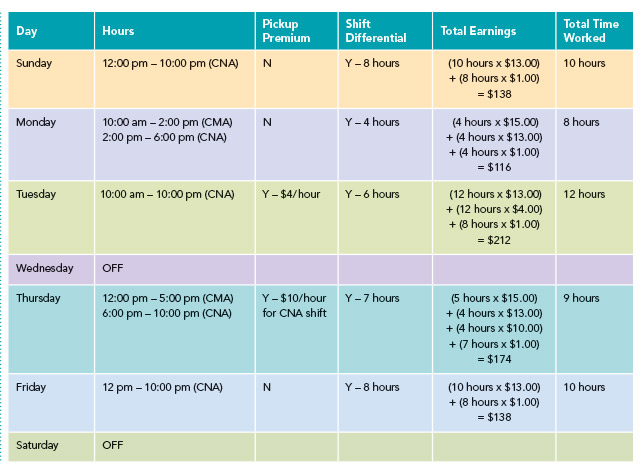

Fictional employee, Pat, works for a center as both a certified nurse assistant (CNA) and as a certified medical assistant (CMA). Pat earns $13.00/hour as a CNA and $15.00/hour as a CMA. All nursing department employees receive a $1.00 per hour shift differential for hours between 2 p.m. and 10 p.m. and a “pick-up” premium for filling vacant shifts, which varies based on the urgency of the need. Pat’s schedule for a recent workweek is on the facing page.

Pat also received a $30.50 attendance bonus for this work week. In total, Pat worked 49 hours and earned $808.50 in straight-time wages.

Pat’s regular rate of pay for overtime calculation purposes is $16.50/hr. ($808.50 divided by 49 hours). This regular rate calculation is where payroll often trips up, failing to include the bonus amount or using one hourly rate instead of the weighted average. Incorrect calculations can result in liability for underpayments, or in the alternative, consistently overpaying employees on top of their costly incentives.

Beware, users of outside payroll companies—many may default to using the hourly rate the employee happens to be working when the overtime hours occur without telling the employer they are doing so. In order to legally use this method instead of the weighted average rate, the employer and employee need an advance agreement, according to 29 CFR. Sec. 778.419.

Additionally, since many work weeks end over the weekend (when premium pay is more likely), using that method will base overtime pay on a rate higher than the weighted average.

Total compensation can be determined with the formula (40 hours x Regular Rate) + (OT hours x 1.5 x Regular Rate). Here’s how the math works out for Pat in this example:

40 hours x $16.50 = $660.

9 hours x 1.5 x $16.50 = $222.75

Total compensation owed is $882.75.

Calculating instead just additional overtime due (Regular Rate x 1.5 x OT hours) and then adding in straight-time wages would reach the same total amount.

An easier path? Not so fast: The Labor Department recently proposed revisions and clarifications to the “fluctuating work week” (FWW) method of determining overtime for non-exempt employees who receive bonuses, which allows employer and workers to agree to a weekly base for all hours worked with only additional half-time pay for hours above 40.

While the proposal would extend FWW rules to bonus payments, the new model is not likely to have broad applications in long term care staffing where non-exempt employees generally have set base and variable OT hours. Long term care employers that may need workers to stay late or meet surge needs may find it difficult to convince employees to work an overtime hour for what may feel to them like a half-hour’s pay.

Getting it Right

These are just a few of the many rules and approaches to properly attract and retain workers through properly calculated bonuses and overtime. There are other compensation arrangemewnts that can alter calculations and allow employers to fully pay and motivate employees while controlling labor costs. There could be state and local regulations, too.

But the headaches of getting it right usually pass with experience, attention to detail, and some help from experts when needed. The pain of getting it wrong while scrambling to keep fully staffed through creative overtime and bonus and incentive packages can last much, much longer.

Michaelle L. Baumert is a principal in the Omaha office of Jackson Lewis. She is a seasoned litigator and has extensive experience in human resources counseling with an emphasis on wage and hour issues. She can be reached at Michaelle.Baumert@jacksonlewis.com or 402-827-4270. Catherine A. Cano is an associate in the Omaha office of Jackson Lewis, representing management in all areas of labor and employment law. She can be reached at Catherine.Cano@jacksonlewis.com or 402-391-1991.