“Everybody wants to go home.” That statement has never been truer for long term care providers that have adjusted their caregiving and bottom-line priorities to include short-stay patients as well as traditional nursing residents in response to demographic shifts, new technology, economics, and the preferences of the aging baby boom generation.

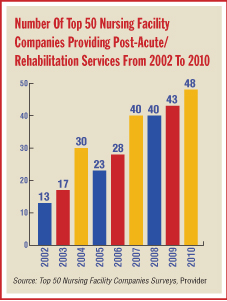

As with the burgeoning culture change movement that is revamping the way skilled nursing facilities (SNFs) look and feel—the Eden Alternative, Green House designs—providers are now bolstering their rehabilitation (rehab), therapy, and temporary housing offerings to tap new revenue streams, while bucking stereotypes of what SNFs do.

SNFs Take On New Look

Scores of SNFs are extending their business lines into short-stay arrangements for residents whose stays are measured in days and weeks as opposed to months and years, or the rest of a lifetime. These new type of residents are often in their 60s or early 70s versus typical nursing facility clients who may be closer to their low to mid 80s.

The short-stay patients are not necessarily frail or elderly and may simply require physical, occupational, or speech therapy following time in an acute care hospital before they return to more independent living.

The focus on these new patients revolves around the “everybody wants to go home” line, which came in a conversation with Parker Jones, administrator of the 164-bed Heritage Hall Nursing and Rehabilitation Center (American HealthCare) in Leesburg, Va., one of a number of such facilities in Virginia. The Leesburg campus Jones operates is like many across the country, as it seeks to fill beds and fill new needs. Jones notes that his facility was built in 1979 but has evolved in many ways since that time.

“Folks do what they need to do and then go back to an assisted living facility [ALF] or independent living. Since January, 58 percent of our residents have been discharged and gone home or to assisted living, and that is fairly typical,” Jones says.

While noting that his facility is 91 to 92 percent occupied, Jones says the average length of stay for “therapy people” is around 28 days. This compares with the two-year-plus national average for a resident’s length of stay in a nursing facility.

“The short-term rehabilitation folks are a positive for us,” he notes, saying facility staff are emotionally satisfied that their work has resulted in success for the patient, while the patient is happy to be feeling better and going back home, and the patient’s family is gratified as well. “Everybody wants to go home,” Jones reiterates.

SNFs Enter Market

There is not much mystery as to why SNFs are eyeing short stays, since the patients in short-term situations represent a higher-paying client base than long-term stays. Medicare pays two to three times more for rehabilitative services than Medicaid does for long term care, pushing SNFs in the direction of expanding their rehabilitation units to attract higher reimbursement and stabilize their finances.

By treating “younger patients” in a post-acute care setting, SNFs are also looking to benefit from a push by the Medicare program to limit the number of enrollees who can receive care at higher-cost rehab hospitals. Medicare recognizes nursing facilities as a lower-cost resource for the scores of patients who need weeks or months in a rehab setting to convalesce following hip or knee replacement, stroke, or the like.

Estimates put these lower SNF costs at up to one-third to one-half of what a rehab hospital charges for what typically is a one-month stay for post-operative care.

What you are seeing is that there are a lot more short-stay acute cases [at SNFs], and this has been happening for a long time as nursing facilities offer more than just long term care,” says Irene Fleshner, senior vice president for strategic nursing initiatives at Kennett Square, Pa.-based Genesis HealthCare, a noted leader in the rehab and therapy space.

“The traditional nursing home is a dinosaur, yet we are still regulated and paid that way,” she says, noting that even though there will always be the need for 24/7 care, the future appears to be more assisted living for those who used to inhabit nursing facilities and more room for SNFs to take on major structural changes to attract short stays.

Mary Jane Koren, assistant vice president for the Picker/Commonwealth Quality of Care for Frail Elders Program at The Commonwealth Fund, says the market, as always, is ruling the decision-making process on where to put resources in the long term care sector.

One of the things going on is that skilled nursing facilities are seeing increased competition from assisted living, so they are reaching out to new populations to help fill those beds. They are finding a new service they can provide to a community and are trying to use this as a new revenue stream,” Koren says.

Health Reform Law Has Impact

Robert Kramer, president of the Annapolis, Md.-based National Investment Center for the Seniors Housing & Care Industry, says when a SNF adds a specialty rehab unit, the quality mix of nursing care in the community immediately improves.

“This is particularly true in an area where you have older skilled nursing properties,” Kramer says.

He sees the trend for more rehab and therapy patients headed to SNFs and says the reasons are based on the economics of long term care and related moves by investors, SNF companies, and related entities to attract more business by updating aging buildings and infrastructure.

“The skilled nursing setting is the lowest-cost facility setting for providing this type of care,” Kramer says. If properly staffed and operated, these rehab units will be very attractive to managed care companies who will be looking to take advantage of opportunities to bundle services. “This makes for a very attractive post-acute care-bundling scenario” with the low-cost SNF and the new rehab and therapy emphasis, he says.

Kramer says the new health care reform law, when implemented over the next few years, will be focused clearly on figuring out cost efficiencies. “There is a lot of discussion going on with [Health and Human Services Secretary Kathleen] Sebelius and the new leaders of CMS [the Centers for Medicare & Medicaid Services] on finding the best quality and clinical outcomes at the lowest-cost setting. They have a lot on their plate, but this is a key area of cost savings by reducing rehospitalizations,” Kramer says.

He thinks it will take CMS the rest of this year to plan guidelines and funding mechanisms to support pilot programs for bundling services, and actual programs will not emerge until 2011, with start dates in 2012.

The shifting economics for SNFs factor in the fact, according to Kramer, that nursing facilities have lost the private-pay customers to ALFs and home-based care, leaving opportunities elsewhere to revamp and remodel and attract the “younger” rehab market.

Investments Required

To attract the new breed of patient/resident, SNFs are putting money into plant restructuring and equipment purchases, along with the most important factor of finding and retaining the skilled therapists and nurses necessary for quality care, or contracting out to companies to get the job done.

Heritage Hall’s Jones points to a number of enhancements to the rehab programs at his 31-year-old facility, including purchases of modern equipment to help improve results and shorten stays.

Some examples of the capital expenditures are the purchase of ACP Omnicycle and NUStep machines for endurance and strength, ultrasound technology for pain relief, Megapulse II Diathermy for pain management and edema control, E-Stim Omnisound 3000 for pain management, and a QualCraft Exerciser for physical rehab.

Jones says electric beds and mechanical lifts have been added for resident comfort and convenience as well as resident and staff safety. There have also been plant upgrades, with the addition of outdoor siding to keep the facility “looking good and presentable to our clients,” he says.

Many nursing facilities have taken the upgrade of their rehab and therapy spaces further, to the point of separating the short-term residents from the long-term, traditional clients, including the use of separate entrances and exits and even changing the facility’s branding to get the words rehab or therapy in the title.

For Jones and his Virginia SNF, the changes are not so dramatic, as all residents enter and leave from the same entrance and exit, but there are distinct differences inside the building related to staffing and logistics.

“We haven’t done [separate entrances]. Everybody comes in the one entrance, but the short-term residents are kept in one unit. This is usually easier for us because our staffing is heavier in the acute units,” Jones says.

Heritage Hall has the equivalent of 10 full-time therapists on staff, but they have distinct skills apart from the nurses and nurse assistants working in the acute wings, Jones says. He notes the occupational, physical, and other therapies are offered six days a week, and a seventh day is possible if an insurance company issues an order for such service.

In Miami, the management at Miami Jewish Health Systems (formerly Miami Jewish Home and Hospital) took a look at the market for its range of long term care services and saw a potentially explosive opportunity in the rehabilitation and short-stay space, noting the expanded demand for a new style of nursing facility care that stresses temporary and targeted therapy over permanent residency.

Blaise Mercadante, chief marketing and communications officer with Miami Jewish Health Systems, says the company markets its rehabilitation services to doctors and hospitals to show the quality of their services and to demonstrate “we’re not just a skilled nursing facility.”

Rehab CARE AT the Right Time

The unique method behind the Miami Jewish take on short-term stays is its use of extensive data collection to match the resident/patient/client with the right care based on outcomes measures for assessing what care worked best.

The company’s marketing focuses on the “right” mantra. “Our systems are designed to a ‘right program, at the right time, i

n the right place’ approach,” Mercadante says. “Whether the individual wants to remain at home, requires short-term therapy, longer-term care, or specialized services, Miami Jewish Health Systems offers quality programs to help maintain their independence and control of their life.”

Miami Jewish’s Rehabilitation Center at Douglas Gardens employs Aegis Therapies to direct physical, speech, and occupational therapy. Aegis Therapies operates in 37 states nationwide by helping patients connect with specialists who operate in nursing facilities, assisted living residences, and their own homes.

An example of the sweeping number of services offered at Douglas Gardens includes electric stimulation, pain management, physical therapy, pneumonia treatment, occupational therapy, speech therapy, and therapeutic recreation. The list goes on to cover administration of intravenous medications, blood transfusions, cardiac monitoring, and diagnostic imaging.

Miami Jewish Health Systems serves around 3,700 people in Miami-Dade, Broward, and Palm Beach counties and lists its clients as being from all age ranges. Chief Executive Officer Jeffrey Freimark says the newly rebranded company’s goal is to ensure quality of care and to expand the range of services for short-term stays and other residents by partnering with managed care stakeholders to compete for post-acute care dollars.

Don’t Over-Promise

Providers say they understand the difference between making promises on available services and delivering on them and stress that finding quality staffers has been a priority of theirs for years, if for long-term or short-term residents. Jones notes that his facility has been able to staff at a higher level in terms of expertise and quality because of the recognition by entrants to the workforce of the opportunities in long term care. The economy, of course, has helped to make workers more readily available, but maintaining the quality of therapy staff is ongoing.

“SNFs have to be careful they are able to provide the level of service they are advertising,” Koren notes.

Marketing efforts to the general population or to discharge planners at hospitals are often taking the form of claims from SNFs that they can deliver comparable service as a hospital, which could be a recipe for trouble if the staffing, facility, and planning are not up to par. “You really need to have enough staff—physical and occupational therapists,” she says.

Fleshner says SNFs cannot compete with hospitals also vying for skilled workers on a salary range basis, so nursing facilities “should be careful” when marketing to the same customer base.

“Some [providers] are overselling,” she notes, adding that hospitals are equipped with emergency rooms, labs, and pharmacies for a reason, because they are the higher-cost option with much higher overhead. She did stress that SNFs can compete well for certain patients as they improve their clinical capabilities and develop an educated workforce.

Koren says there is definitely a balancing act going on. On the one hand, managed care companies and others are looking to bundle their patients to send to SNFs, which offer the lowest cost alternative in the provider marketplace. “But how [SNFs] stay low cost” when trying to compete with hospitals and other rehab providers by staffing at a higher level and with modern equipment is another matter.

“The bottom line is that they really have to provide high-quality care,” she says.

What SNFs should be focused on, besides the obvious need for making their short-stay business thrive, is how success for the short stays can translate into an overall winning strategy for the future, experts say.

Attract Future Residents

“Short stays are really opportunities for nursing facilities to market themselves to the community, and if they succeed, they will reap the benefits throughout the community,” Koren says.

She notes that word of mouth is the most reliable way nursing facilities get business, so by pleasing the “younger” residents in rehab and therapy, they can build a bridge to these same people and their families when the time may come for permanent residency later on.

“It’s like families asking: ‘Weren’t you there for your hip rehabilitation?’ and saying yes to the question of whether they want to put their mothers in there later. You have to make sure the staff is good, the food is good. Nursing facilities really have a great opportunity to capitalize on all the things they can do, and do well,” Koren says.

The subject of marketing to short stays so they can become residents later on bridges into the culture change topic. The slightly younger groups in for rehab are expecting amenities that the more elderly may not. This demographic difference, catering to the beginning fringes of the baby boom generation, can translate into SNFs remodeling their short-stay spaces, to have the flat screen televisions available, the private bathrooms, and diverse food choices and preparation methods.

It all goes together, providers say. The new look and feel and new clinical and care offerings make the old model for SNFs just that: old.

Covenant Care: A Prototype For Success

Doug Shuck, vice president of operations-Midwest for Aliso Viejo, Calif.-based Covenant Care, offers his company’s Springfield, Ohio, long term care facility as a textbook example of what the future business model will look like for many in the long term care sector.

In 2005, Springfield was a very traditional long term care facility, enjoying a positive reputation for quality care and boasting an average occupancy of 92 percent. Its skilled nursing census averaged 18 patients.

“However, we were facing some challenges to our traditional business model,” Shuck says. “Assisted living facilities were entering the market and siphoning most of the private-pay business. The demand for short-term rehabilitation services was increasing, and patients were demanding private rooms, modern amenities, and cutting edge therapy programs.”

Since typical consumers today are much better informed because of the online revolution, these new service demands were entering more and more into their decision making on where to put their long term care dollars.

“Furthermore, the state Medicaid program was not paying us enough to cover our costs for caring for the state’s indigent patients,” says Shuck. “In addition, more Medicaid funds were being diverted to home- and community-based options under the state’s waiver program.”

As many providers know and are fighting to correct, Medicaid reimbursement is also becoming unpredictable at best and severely lacking at worst.

Shuck says based on unanticipated changes instituted in 2009 by Ohio’s Medicaid program, Covenant Care will see an estimated $1.2 million reduction in revenue to its Ohio facilities. “How can we make business decisions related to competitive wages and benefits or capital improvements for outdated buildings when we do not know if our reimbursement will be unexpectedly reduced? As a result, we found it necessary to reevaluate our business strategy,” he says.

This is when the Springfield reinvention took place.

Click

HERE to read about providers' efforts to offer respite care services.

Investing In Rehab Therapy

“We made the decision to invest heavily in reinventing the Springfield facility into a state-of-the art rehabilitation facility as an adjunct to our traditional long term care business model,” Shuck says.

“In May 2008, we opened a $2.1 million addition to the Springfield facility. This 8,210-square-foot facility includes 12 large private rooms, a dining room, and a 1,402-square-foot therapy gym.”

As part of the expansion and remodeling, the company purchased $70,000 in state-of-the-art therapy equipment. The addition of the 12 private rooms also led to the creation of 12 more private rooms in the existing facility. In total, the Springfield facility has 30 private rooms, and the high demand keeps those rooms at 100 percent occupancy.

Shuck looks back at 2005 and notes that Medicaid represented 69 percent of the Springfield patient mix and 52 percent of total revenue at that time.

“In 2009, those numbers fell to 58 percent and 35 percent, respectively, as revenue from short-term rehabilitation services continued to grow at a record pace,” Shuck says.

Rehab Therapy Partners

The Springfield facility, called Villa Springfield, employs 14 therapists, and Covenant Care partners with Select Therapies to fill these slots and keep updated on the latest technology available for its operations. Again, the goal is to admit patients with an eye to returning them home or to their previous living arrangements as soon as is feasible.

“A patient’s best opportunity to return home begins when he/she is admitted to Villa Springfield for therapy services. We returned home 181 patients in 2009 out of 326 total admissions, or 55 percent,” Shuck says.

Some 18 percent of the discharged patients from the rehab program were under 65, and 40 percent of all admissions in 2009 were former patients at Villa Springfield.

The facility also offers a Transitional Living Unit that simulates a home living environment and includes a bedroom, small living area, efficiency kitchen, and full private bathroom. In some facilities, it may also have a washer and dryer.

Shuck notes that outpatient services continue to expand as well, averaging 10 patients per month. Just last year, Villa Springfield received the company’s highest award, the Chairman’s Award, and a Better Business Bureau International Torch Award for Business Integrity that was presented in Washington, D.C., this past April.

The range of ideas for short stays is broad, and the opportunities apparent to most SNFs looking beyond their traditional role. In the end, the nursing facility will always be a mainstay for the old and frail to spend their final years, but the baby boomers who are having surgery will need recuperation space, and that is an area for vast growth among SNFs eyeing the new market, experts say.