The skilled nursing sector continues to navigate through a challenging environment. Patients are bypassing skilled nursing facilities (SNFs) and going straight home. More complex procedures are taking place in an outpatient setting, making for fewer skilled nursing center admissions. Medicare Advantage is also putting pressure on the length of stay allowed under the program.

However, most experts agree that the skilled nursing sector will continue to be a valuable proposition within the health care delivery system as the population continues to age and the demand for lower-cost settings increases because of budgetary constraints, which by no means are easing any time soon.

Staying Ahead of the Trends

That said, as the sector continues to find its way through the next few years, it is prudent to stay abreast of the latest trends, especially the ones that are of importance to both operators and capital providers.

The latest trends below are based on data that are collected monthly and reported quarterly in the National Investment Center (NIC) Skilled Nursing Data Report, on a national aggregate level, from approximately 20 operators and 1,500 properties. The plan is to grow the data set to include more operators and properties, which will allow NIC to report at the state level. Operators around the country are welcome to participate and will receive a free benchmark report every month for their participation.

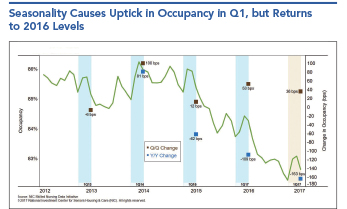

To start, the occupancy data below are through March 31, 2017.

Quarter-Over-Quarter Occupancy Up

Occupancy increased 36 basis points from last quarter to 82.6 percent, demonstrating the expected seasonality as the first quarter usually sees an uptick from the fourth quarter. However, occupancy decreased from the month of February after exceeding 83 percent for the first time in eight months.

Occupancy has not exceeded 84 percent since March of last year, and it hasn’t reached 85 percent since April 2015.

The average occupancy for the past 12 months was 82.9 percent, compared with 84.3 percent for the prior 12 months and 85.7 percent for the 12 months before that. If occupancy continues at this rate of decline year-over-year, a new low will be expected later in 2017.

Year-over-year occupancy dipped 163 basis points from 84.3 percent, continuing the downtrend over the past couple of years. The graphic below includes more occupancy details over the past five years, which includes year-over-year and quarter-over-quarter changes.

Highest Occupancy in First Quarter, As Expected

Over the past couple of years (in 2015 and 2016), the first quarter represented the high point for occupancy in each year. The first-quarter data typically show an uptick in occupancy due to seasonal factors, such as the flu, as admissions to skilled nursing properties increase during that time of year. There was a monthly occupancy rate decline in March after increases in January and February, and considering the current environment in post-acute care, competition for Medicare patient days is higher than at any time in recent memory for skilled nursing operators.

Many factors, such as sending patients directly home from the hospital, are contributing to occupancy challenges. Therefore, occupancy could feel additional pressure until the supply and demand equation comes into better balance.

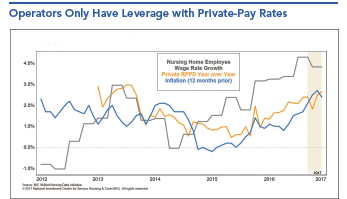

Private RPPD Increased

Private revenue per patient day (RPPD) rose 1.5 percent quarter-over-quarter and by 2.7 percent on a year-over-year basis. In March 2016, the RPPD was $251.85, and it rose to $258.53 as of first-quarter 2017.

The yearly increase may not be enough to offset the decline in private patient day mix, which has fallen year-over-year by 62 basis points, although most of the decline in private patient day mix occurred in the last quarter. Private RPPD is one way operators can mitigate revenue loss from decreased occupancy and skilled mix, which may help to explain why the private RPPD has increased in recent quarters.

Wage Growth Outpaces Private Reimbursement Rate

The private reimbursement rate has grown at a healthy clip, faster than the overall Consumer Price Index (CPI), which stood at 2.4 percent as of first-quarter 2017. However, the private reimbursement rate has not kept pace with the latest nursing center wage growth of 3.8 percent. The below exhibit shows the trend in comparison to wage growth and inflation (overall CPI).

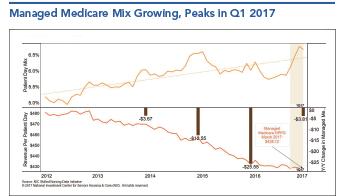

Managed Medicare Patient Day Mix Trending Up

Managed Medicare patient day mix reached its highest point within this time series in the first quarter in the month of February at 6.8 percent.

Managed Medicare patient day mix increased quarter-over-quarter and on a year-over-year basis, mirroring the trend in managed Medicare seen in the first quarter of 2015, which also experienced a relatively significant flu season.

Quarter-over-quarter Managed Medicare patient day mix increased to 6.7 percent from 6.1 percent in the last quarter of 2016. In March 2016, this patient day mix was 6.0 percent.

As this patient day mix is trending upward and reached the highest point in the data set in the first quarter in the month of February, it reflects the growing importance of managed Medicare within the skilled nursing sector. Paying attention to managed Medicare trends will become ever more important, as nearly half of all seniors may be enrolled in managed care over the next 10 years.

Quarter-over-quarter, managed Medicare RPPD increased, marking the first time in two years that managed Medicare RPPD increased quarter-over-quarter. The increase, while small, reinforces earlier NIC analysis suggesting a trend away from what had been a rapid decline in the managed Medicare RPPD.

Quarter-over-quarter, it increased 0.01 percent from $428.07 to $428.12. Year-over-year the measure was still down as it decreased 0.9 percent, from $431.93 to $428.12.

Skilled Mix and Quality Mix Increased Quarter-over-Quarter

The uptick in Medicare and managed Medicare patient day mix were the drivers behind increased quality and skilled mix in the first quarter, which is not unexpected in terms of seasonality and which may have been heightened by the relatively more significant flu season.

Quality mix increased quarter-over-quarter, from 33.9 percent to 34.8 percent. However, it decreased year-over-year from 35.7 percent. Skilled mix followed the same trend as it was up quarter-over-quarter from 24.2 percent to 25.7 percent but down, year-over-year, from 25.9 percent.

Medicare mix increased 89 basis points quarter-over-quarter from 12.9 percent to 13.7 percent. Despite this recent increase, it decreased year-over-year by 82 basis points from 14.6 percent. In addition, the average Medicare mix for the last 12 months decreased by 116 basis points, compared with the average for the previous 12-month period (April 2015 to March 2016). Also, the average Medicare mix for the previous 12-month period decreased by 99 basis points from the average for the 2014-2015 period, following the same trend as overall occupancy.

To Succeed, Put Outcomes First

The pressure felt by most skilled nursing operators stems from the decline in length of stay and the overall decrease in Medicare patient days. Hence, the sector is really dealing with a supply and demand issue in terms of available Medicare days and the demand for those days.

Many believe the occupancy issues today will be a short-term problem, as the aging population and the favorable demographics become a positive as far as demand in the 2020s and 2030s.

Of course, the exact timing of occupancy increases is certainly a wild card, but as the move to value-based purchasing is likely to continue due to budget constraints, there could continue to be pressure on the economics of the business until more consolidation occurs and/or the weaker operators exit the business.

The operators that are most likely to win are the ones that are nimble, able to navigate this environment by providing the best outcomes, and can avoid rehospitalizations when caring for complex patients.

Bill Kauffman, CFA, is senior principal at the National Investment Center for Seniors Housing and Care. He can be reached at bkauffman@NIC.org or (443) 837-2429.