Although 2018 was not without its challenges in both the skilled nursing and private-pay seniors housing sectors, liquidity was not one of those challenges. Indeed, not only was there strong dollar volume registered in terms of closed sales transactions, but the sheer number of transactions closed was greater than in 2017.

Seniors housing and care transactions volume in 2018 registered $13.9 billion, with the third and fourth quarters representing 62 percent of that closed sales transaction volume. This total includes $8.4 billion in seniors housing and $5.5 billion in nursing care (aka skilled nursing). The total volume was down 14.4 percent from the previous year’s $16.2 billion, and down 5 percent from 2016, when volume came in at $14.6 billion.

Number of Deals Up

However, even though the closed dollar figures were down from the last year, the number of deals closed in 2018 outpaced 2017, with many smaller portfolio and single-property transactions, hence the lower dollar figures from 2018. There were certainly signs of plentiful liquidity continuing in 2018.

It is possible that 2018 could have been even stronger, in regard to the number of deals closed, but the tough month of December in terms of volatility in the capital markets, including the widening of credit spreads, may have pushed some deals due to close before year-end into the first quarter of 2019.

In addition, some of those possible end-of-year deals pushed into the first quarter of 2019 could be delayed further if they were dependent on Housing and Urban Development (HUD) financing, as the government shutdown likely impacted the availability of staff at HUD offices.

As mentioned, the third and fourth quarters of 2018 represented a significant portion of the total closed volume in the year, but a majority of that was due to the third-quarter close of the relatively large Welltower/QCP transaction with the ManorCare properties.

When looking at seniors housing and nursing care separately, the seniors housing dollar volume was down, along with nursing care from 2017 levels. Seniors housing saw a 10.8 percent decrease in dollar volume from $9.4 billion, and nursing care was down 19.5 percent from $6.8 billion in 2017.

When comparing the fourth quarter of 2018 to a year ago, total volume of seniors housing and nursing care in the fourth quarter of 2018 registered $3.5 billion, up 22.7 percent from the $2.9 billion a year ago in the fourth quarter of 2017. This was the highest fourth-quarter volume since 2015, when it registered $5 billion.

In comparison to the previous quarter, volume was down 30.5 percent, as the third quarter of 2018 totaled $5.1 billion. The main driver of that decrease was on the nursing care side as it decreased in volume by more than 70 percent, an indicator of how much the QCP deal influenced the third-quarter nursing care volume. Seniors housing was up 27 percent.

Of the $3.5 billion in the fourth quarter of 2018, seniors housing made up $2.8 billion, and nursing care made up only $780 million of the total volume.

When it comes to the number of deals closed, a measure different than dollar volume, there were continued signs of a very strong transaction market. There were 514 deals closed in 2018, of which 85 were portfolio transactions and 429 single-property transactions. That compares to the 502 transactions closed in 2017, of which 101 were portfolio and 401 were single-property transactions.

Single-Property Deals Dominate

Portfolio transactions have consistently represented about 20 percent of overall closed transactions over the past few years, including in 2015 when the public buyer type, namely the publicly traded real estate investment trusts (REITs), were more active with larger deals. However, 2018 saw portfolios represent closer to 16 percent of the total, highlighting the fact that single-property transactions are very important to the market in terms of the flow of closed transactions. There have been 21 straight quarters with more than 100 total deals closed.

As far as the size of the deals, small deals of $50 million or less dominated in the fourth quarter, which is typical in every quarter given the large percentage of single-property deals, representing about 89 percent of all deals closed. The past few years have seen a significant decrease in large deals of $500 million or more. In 2015 there were 10 transactions of $500 million or more and only 10 combined in 2016 and 2017, and only one in 2018. However, there was a significant pick up in deals between $250 million and $500 million, as only two were closed within that range in 2017 but seven were closed in 2018.

Here is a deeper look at the buyer trends for 2018.

Private Buyers Still Very Active

A notable trend is that participation by the institutional buyer decreased significantly from 2017 to 2018 as a share of volume. Also, the public and private buyers increased as a percentage of closed volume. The public buyer category is just that—any publicly traded company. The private type is any company that is not publicly traded—for example, a private REIT or single owner or partnership. The institutional type usually consists of the equity funds that manage pension money or other types of institutional money.

The institutional buyer type represented only 19 percent of the $13.9 billion in closed transactions in 2018, a decrease of 48 percent from 2017 when it represented 32 percent of volume with $5.2 billion in closed transactions. However, 2017 was represented in a significant way by Blackstone, within the institutional category, with some closed deals over $500 million.

For additional comparison purposes, the institutional buyer closed $3.9 billion in 2016, representing 27 percent of closed volume that year. The institutional buyer has averaged $3.9 billion in closed transactions per year over the past three years.

Public, Private Buyer’s Representation Increase

From the public buyer side, its representation of volume increased from 25 percent in 2017 to 29 percent in 2018. Closed dollar volume held relatively steady at $4 billion in both 2017 and 2018. In 2018, the volume was primarily carried by the Welltower/QCP deal, and in 2017 by the Sabra/Care Capital Properties deal. The public buyer has also averaged $3.9 billion in closed transactions per year over the past three years.

The private buyer continues to be the most consistent and steady source of capital as it registered close to $6 billion in closed transactions in 2018 at $5.9 billion. It represented 43 percent of all volume in 2018, up from 34 percent in 2017 when it closed $5.5 billion in transactions. Over the past three years, the private buyer has averaged $5.7 billion, closing above $5 billion in transactions for five straight years.

Lastly, just to touch on cross-border activity, there has been a steady decrease in that dollar volume ever since the 2015 time period, when it registered $2.1 billion. It has averaged about 5 percent of total deal volume over the past three years, and only closed $500 million in 2018, down from 2017’s $900 million.

Skilled Nursing (Nursing Care) Price Per Bed Down

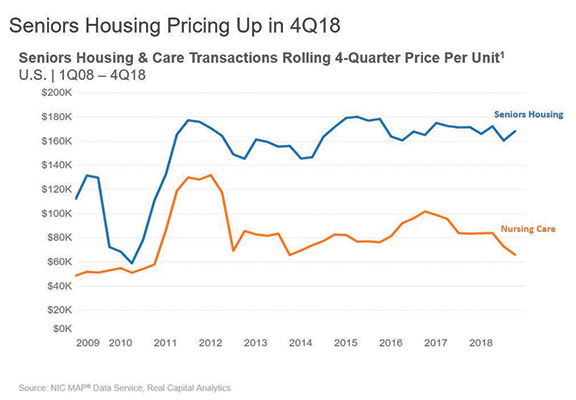

Comparing the third quarter with the fourth quarter of 2018, seniors housing was up, and nursing care pricing was down, as measured by the rolling fourth-quarter price per unit/bed. Compared to a year ago seniors housing and nursing care were both down, although the magnitude was significantly different, which will be discussed shortly.

Looking at private-pay seniors housing, the price per unit increased by 4.8 percent in the fourth quarter, from $160,500 in the third quarter of 2018 to $168,200. On a year-over-year comparison, however, seniors housing price per unit is down 2.0 percent, from $171,600.

Nursing care price per bed dropped 9.3 percent in the fourth quarter of 2018, from $72,800 in the third quarter to $66,100. Year-over-year, nursing care price per bed is down a significant 20.9 percent from $83,500 in the fourth quarter of 2017.

In summary, seniors housing, from a pricing perspective in 2018, continued to be somewhat stable even with the challenges of occupancy and labor over the past couple years. The nursing care pricing story is certainly different. It seems pricing has reflected the numerous challenges in that sector over the past few years. One of those challenges has been occupancy, although there were signs of some possible beginnings of occupancy bottoming out. However, time will tell as the market progresses through 2019.

Skilled Nursing Occupancy

Although one quarter does not make a trend, occupancy figures from the third quarter 2018 NIC Skilled Nursing Data Report (see box below for access details to the latest report) brought some welcome news to the sector, as overall occupancy increased 14 basis points to 82.2 percent in the third quarter.

The quarterly increase is notable because occupancy has declined or been flat between the second and third quarters for the past three years. In addition, occupancy has been relatively flat over the past six months, hovering around the 82 percent range. However, it was nearly a full percentage point below year-earlier levels.

Occupancy has been challenged on many fronts over the past few years, with pressure on lengths of stay from Medicare Advantage insurance plans and competition from home health, as more patients have been discharged directly home from the hospital instead of entering a skilled nursing facility.

So why the relatively stable occupancy trend over the past six months? One answer might be the fact that supply and demand are coming into balance. However, it would be prudent to see if the trend continues into the spring of 2019 as the sector navigates the typical seasonal pattern with the flu season and winter months. The flu season and winter months can be challenging to see how the demand side is truly playing out.

Occupancy trended up quarter-over-quarter in both urban and rural areas, but it was down in urban clusters. Occupancy finished the third quarter at 83.5 percent and 80.5 percent in urban and rural areas, respectively.

For More Information

For additional information and trends, The NIC Skilled Nursing Data Report is available at http://info.nic.org/skilled_data_report_pr. There is no charge for this report.

The report provides aggregate data at the national level from a sampling of skilled nursing operators with multiple properties in the United States. NIC continues to grow its database of participating operators in order to provide data at localized levels in the future. Operators who are interested in participating can complete a participation form at www.nic.org/skillednursing. NIC maintains strict confidentiality of all data it receives.

Bill Kauffman, CFA, is senior principal at the National Investment Center for Seniors Housing and Care (NIC). He can be reached at bkauffman@NIC.org.