The National Investment Center for Seniors Housing & Care (NIC) released its Skilled Nursing Data Report with data through the first quarter of 2018. Different from the last quarter report, this report now includes revenue mix and urban vs. rural trends. The main takeaways include:

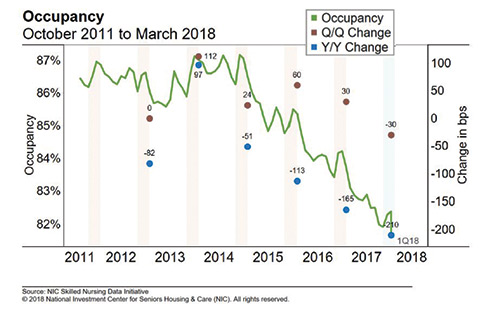

1. First quarter national occupancy decreased 30 basis points from the fourth quarter to 81.6 percent.

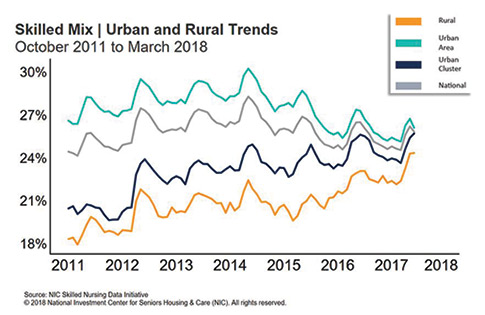

2. Skilled mix increased at the national level from the prior quarter.

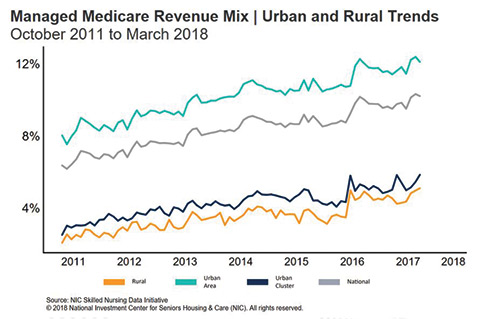

3. Managed Medicare revenue mix reached a time-series high at the national level in February 2018.

4. Medicare revenue mix increased in the first quarter and was close to the highs of one year ago in urban cluster and rural settings.

5. Nationally and consistently across geographic areas, private revenue per patient day continues to increase.

Occupancy Continues to Fall, Despite Seasonal Influence

First quarter national occupancy decreased 30 basis points from the fourth quarter to 81.6 percent, diverging from the expected historical trend that usually shows an uptick in occupancy from the fourth to the first quarter. Occupancy initially increased in both January and February before slipping in March as occupancy ended down 210 basis points from the March 2017 rate of 83.7 percent.

From the January 2015 high in this time series of 87.2 percent, occupancy is down 555 basis points. And remember, 2015 was when value-based health care started to take hold and many challenges began to appear in the skilled nursing sector, such as pressure on length of stay—and the data here reflect that.

From the January 2015 high in this time series of 87.2 percent, occupancy is down 555 basis points. And remember, 2015 was when value-based health care started to take hold and many challenges began to appear in the skilled nursing sector, such as pressure on length of stay—and the data here reflect that.

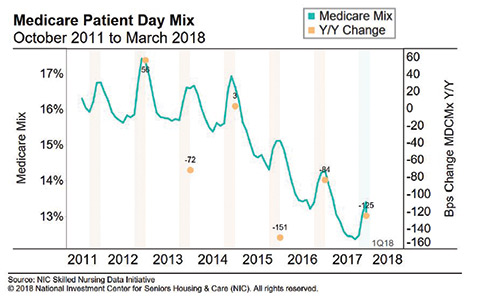

Medicare patient day mix increased 56 basis points to 13.0 percent in the first quarter of 2018. This suggests that seasonality did once again influence the data as higher-acuity patients are often admitted during the winter/flu season, which in turn often drives an increase in overall occupancy. However, as mentioned above, overall occupancy decreased so other factors may be at play that are offsetting this influence, such as lower admissions or pressure on length of stay.

Throughout the time-series on page 47, the spike each year in Medicare mix due to this seasonality can be seen, but each year since 2014 has seen a lower level, reflecting the challenges to increase the Medicare patient day mix in the skilled nursing sector.

Urban and Rural Trends

As briefly mentioned in the beginning of this article, the data set now includes urban and rural trends, but as many might guess, the overall occupancy trends over the past few years are similar. Although occupancy was down overall nationally and in urban and rural areas, the urban cluster area was actually up 24 basis points from the fourth quarter of 2017 to the first quarter of 2018.

However, the urban cluster was down similar to that of other areas when compared to last year. Also worthy of note is the fact that there was a sharp decline in rural occupancy, which decreased a significant 100 basis points from December 2017 to March 2018.

However, the urban cluster was down similar to that of other areas when compared to last year. Also worthy of note is the fact that there was a sharp decline in rural occupancy, which decreased a significant 100 basis points from December 2017 to March 2018.

Exploring additional comparisons within different geographies, skilled mix increased at the national level from the prior quarter as Medicare and managed Medicare patient day mix increased 56 and 54 basis points to 13.0 percent and 6.6 percent, respectively. As mentioned earlier when describing the recent Medicare patient mix trends, this skilled mix increase suggests that seasonality did influence the data as higher acuity patients are often admitted during the winter/flu season, which in turn often drives an increase in overall occupancy.

Skilled mix increased across all reported geographic areas in urban, rural, and urban cluster markets. Rural area properties are now at the highest level of skilled mix within the time-series, ending the quarter at 24.4 percent.

Managed Medicare Still a Factor

Managed Medicare revenue mix reached a time-series high at the national level in February 2018, demonstrating the growing influence of this payer source. Even among rural properties, where revenue mix for managed Medicare is less than half the revenue mix reported in urban areas, the trend is consistent. Rural areas have been less affected by managed Medicare than others, but the trend warrants attention in the years to come, in all geographic areas.

The challenge on the managed Medicare business is not only the pressures on length of stay, but also the reimbursement rate differential between fee-for-service Medicare and managed Medicare, which has been pressured over the last few years. Based on the patient day mix and reimbursement rate data, it is clear that managed care growth continues to progress, and as more patient days transition from fee-for-service to managed Medicare, there will continue to be pressure on daily reimbursement.

The challenge on the managed Medicare business is not only the pressures on length of stay, but also the reimbursement rate differential between fee-for-service Medicare and managed Medicare, which has been pressured over the last few years. Based on the patient day mix and reimbursement rate data, it is clear that managed care growth continues to progress, and as more patient days transition from fee-for-service to managed Medicare, there will continue to be pressure on daily reimbursement.

For further insights and data, download the latest report. NIC’s Skilled Nursing Data Report is released quarterly to provide operators and investors timely, relevant data that are not readily available from other sources. Select metrics include: occupancy, quality mix, skilled mix, patient day mix, and revenue per patient day by payor source. The first quarter 2018 report features time series data from October 2011 through March 2018. This report, in addition to the skilled nursing quality metrics recently launched through NIC MAP® Data Service, represents NIC’s growing commitment to transparency in the skilled nursing sector. The NIC Skilled Nursing Data Report is available at http://info.nic.org/skilled_data_report_pr. There is no charge for this report.

The report provides aggregate data at the national level from a sampling of skilled nursing operators with multiple properties in the United States. NIC continues to grow its database of participating operators in order to provide data at localized levels in the future. Operators that are interested in participating can complete a participation form at http://www.nic.org/skillednursing. NIC maintains strict confidentiality of all data it receives.

Bill Kauffman is senior principal at the National Investment Center for Seniors Housing & Care (NIC). He can be reached at bkauffman@nic.org.